Telehealth Patiently Waiting To Be Called In

Hey Founders,

Telehealth is having a moment right now. With global psyche engrossed in COVID-19 press, this could be telehealth's 'put-me-in-coach' moment. Sure, it has shown promise before. But now, it has serious boosters demanding immediate playing time. Who are those boosters?

Last week, top officials at the CDC called for decreasing admissions by, "Triaging patients differently, looking at how to increase telehealth services, and delaying elective surgery". Then both the AHA and ANA called upon congress to provide an additional $1 Billion in emergency funding meant in part to, "Plan, train, and implement expanded telemedicine and telehealth capabilities to ensure that appropriate care can be provided to individuals in their homes or residential facilities when social distancing measures are used to reduce virus transmission". This connotation doesn't paint telehealth as a convenient, cost-saving solution, but as a necessity. Let's dive deeper.

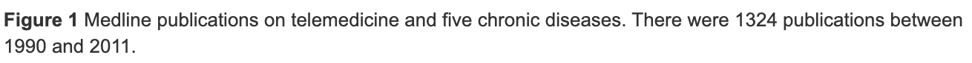

| Snapshot: Medline Publications on Telemedicine 1995-2011 |

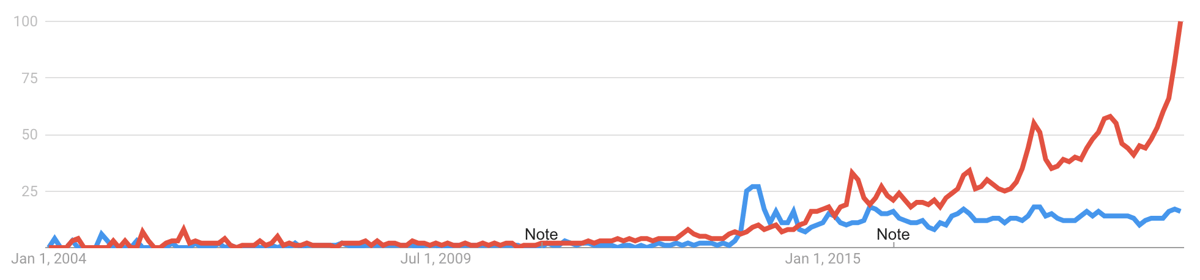

The Journal of Telemedicine and Telecare chart above shows how research and professional interest in telemedicine solutions began to grow through the turn of the century. From a public interest perspective however, measured unofficially using Google search term volume, the opposite was true of public interest as it actually declined over the second half of this same time period through 2011. This indicates an imbalance between enterprise interest and public demand for telehealth up the last decade.

Telehealth In the Last Decade

To bridge the gap time closer to present day, we looked at a JAMA study of 217,851 patients that found telehealth utilization expanded from 2005 through 2014 at an, "annual compound growth rate of 52%". When did growth really start to pick up?

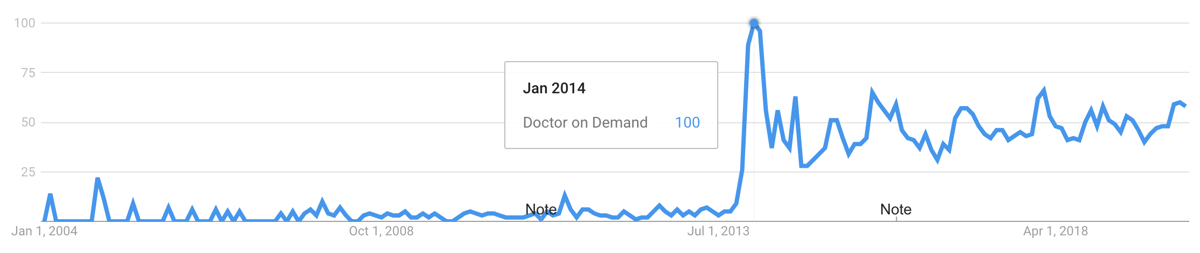

There seems to be a particular tipping point leading up to 2015, when coverage expanded for direct-to-consumer primary care telehealth services. Expanded coverage helped cause a 261% annual compound growth rate between 2015 and 2017, with primary care ending the period as the most popular telehealth service. This mirrors the search volume chart below which shows peak interest for the telehealth app 'Doctor on Demand' just before this inflection point in 2014. Still, the study does conclude, "Although telemedicine use increased substantially from 2005 to 2017, use was still uncommon by 2017".

Telehealth App Popularity in 2020

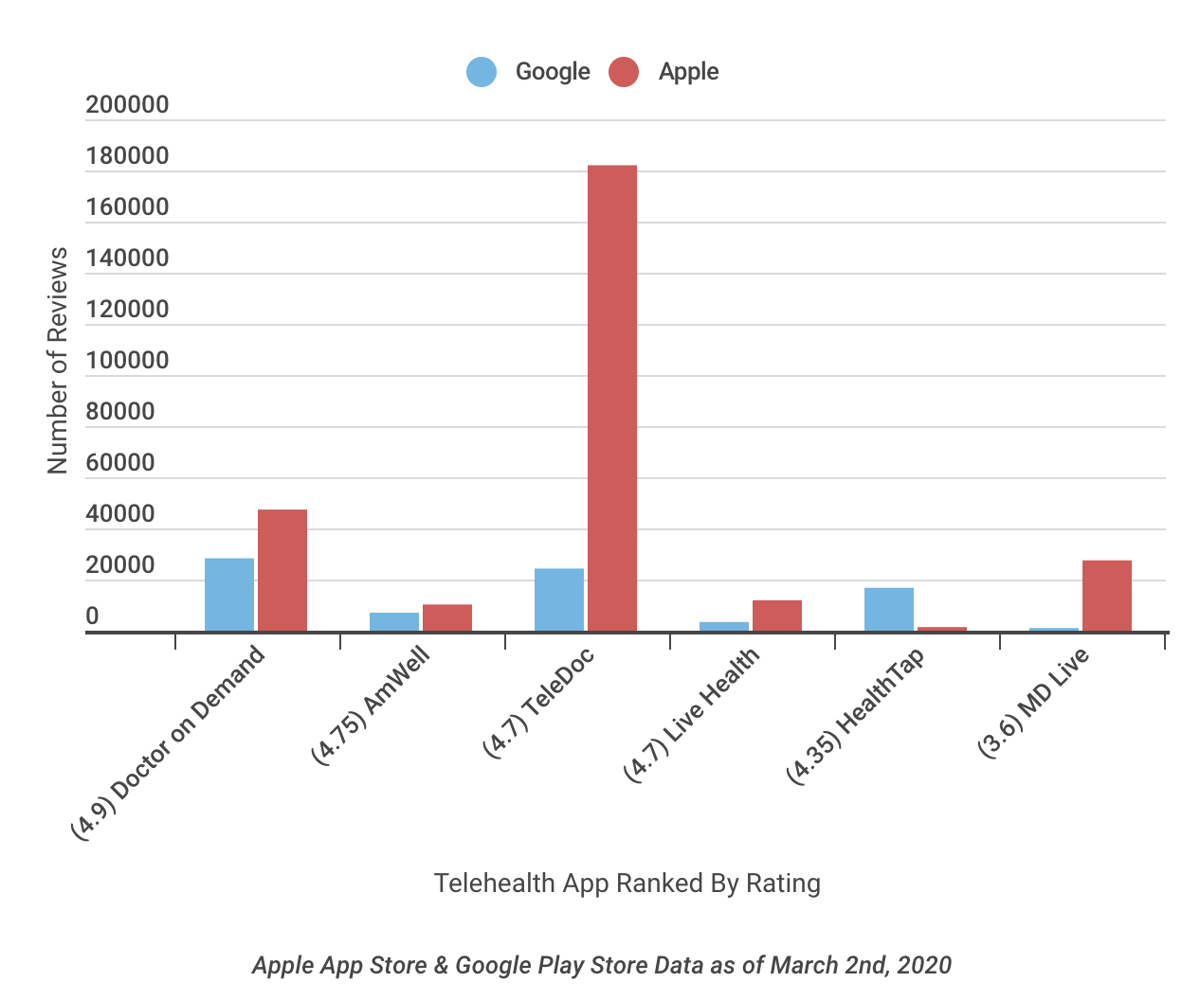

We looked at six popular telehealth apps and measured their adoption by considering total number of reviews across the Google and Apple app stores. The apps are ordered from left to right according to their combined average rating across devices.

- The clear winner among this set is Teladoc which has over 206k reviews, the vast majority of which are on Apple. In fact, Teladoc's Apple traction alone is actually 20% higher than the combined sum of all competitor reviews across devices.

- Despite variance in number of ratings, the average rating spread is narrow. With the exception of one skewed outlier, the set has relatively equal scores ranging from 4.3 to 4.9 in average rating.

Right now Teladoc is at an inflection point. It is riding the wave of broader calls for increased telehealth usage. The chart below shows the company's search term popularity in red over top of the previously displayed search popularity for 'Doctor on Demand'.

Reflected below, popularity has translated into value. Teladoc (TDOC), which had an IPO in 2015, currently has a market cap over $9 billion and is trading at an all time high. As analysts adjust their forecasts, this may be telehealth's moment to shine.

Office Hours & Upcoming Events:

HIMSS 20 | March 9-13 | Orlando

The HIMSS Healthcare Conference brings together thousands of investors, enterprise executives, and startup founders to network and learn about the most important trends in healthcare. Our team will at the event meeting with startups for Office Hours to learn about their companies and share more about our program and fund. Book Here

MedCity Invest | April 21-22 | Chicago

Over 400 venture capitalists, equity and other investors, influential healthcare executives, and tech entrepreneurs in digital/health IT, medical device and other areas will attend. Save 40% over the full rate when you use code DREAMIT - limited time slots at this event. Register Here

How To Talk Vision When Pitching Investors

How to Calculate Your Startup's TAM

Dreamit Portfolio Company Updates

Follow Dreamit

👋🏼 Subscribe to the Dreamit Newsletter